Legal Procurement Metrics: Preferred AFAs and Spend Management Tools

By Matthew Prinn

December 15, 2021 | 8-minute read

Business Development Competitive Intelligence Content Type Article

Marketing Management & Leadership

In the first two articles of his three-part series based on key metrics and takeaways from the Buying Legal Council 2021 Marketing Intelligence Report, Matthew Prinn, RFP Advisory Group, took a deep dive into the minds of legal procurement professionals, looking at metrics they prioritize, and discussed which value-adds are preferred by legal departments. In his final installment, he reviews pricing models and outlines which are most preferred and what tools are being used to manage legal spend.

Legal Department Metrics

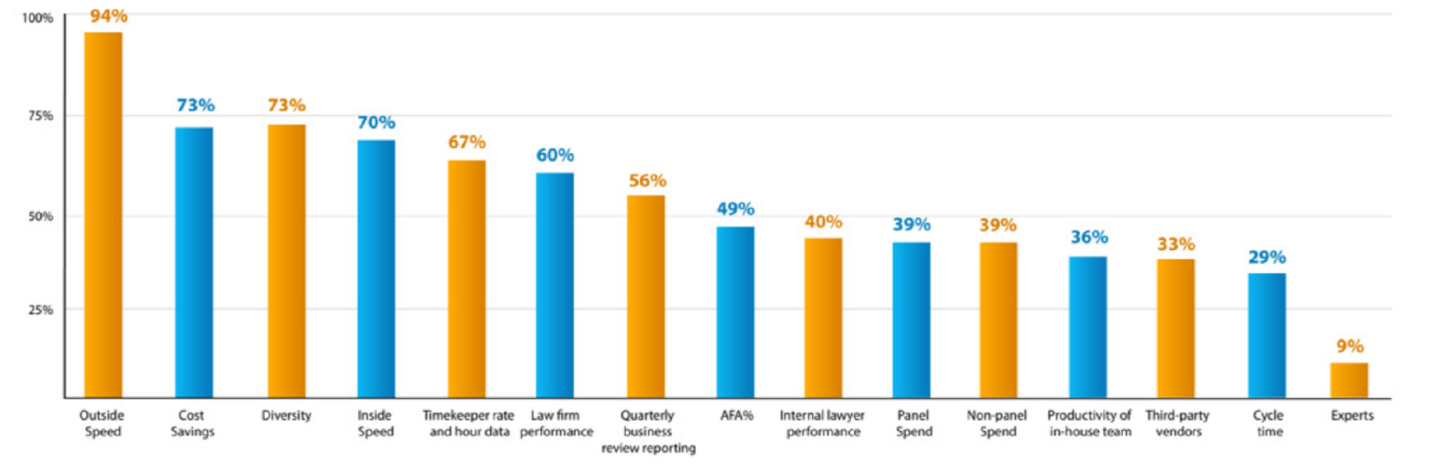

Law firms understand that legal departments regularly track a range of metrics, including outside spend, cost savings, diversity, inside spend, timekeeper rate and hour data, law firm performance and others.

The graph below identifies the top 15 metrics currently being used by legal departments; more than half off the metrics noted are related to spend and savings, but law firms should be aware of the additional areas that are growing in relevance such as diversity. In this article, I will take a closer look at legal procurement’s preferred pricing models based on the results of recent industry surveys and share how these results align with future growth predictions from Buying Legal Council’s 2021 Marketing Intelligence Report.

Source: Exhibit 21. Which of the Following Does Your Law Department track? (Blickstein Group/Legal Value Network).

Usage

The most frequently used pricing models are:

- Fixed fees

- Straight discounts

- Capped fees

- Blended rates

This is not surprising because these are the easiest billing models to create, as they are all closely related to the traditional billable hour. The “risk” in straight discount, capped fee or blended rate models fall on the purchaser of the legal services. In the fixed fee model, some of the risk shifts to the law firm as they take on the chance they will go over budget, although it opens up an opportunity for them to increase the profit margin if they are able to incorporate cost efficiencies that allow them to complete the project under the fixed fee. One trend we are seeing is that risk collars are being used more often as a way for the legal department and law firm to agree to a fixed fee — but still have some coverage in case the cost of the matter goes too far in either direction.

The least frequently used pricing models are:

- Flat fees with shared savings

- Contingency fee arrangements

- Bundling fee arrangements

- Packaging fee arrangements

The survey noted that the more complex billing models that include risk and reward sharing are least frequently used. These models require a greater level of transparency, data sharing and trust between the law firm and legal department. They also require that both sides identify and agree upon the definition of “success” on a matter and determine which metrics to use to measure success. A strong legal performance may not always equal positive business results and can lead to disagreements over what may qualify as success in a contingency-based model.

The report also surveys legal procurement professionals on the popularity of billing models. Discounts and fixed fees were the leading responses, with the least popular being contingency fees, flat fees with shared savings and bundling fee arrangements. I believe the reason for the popularity is that the most popular models are also the models where it is the easiest to measure savings — which is a top priory for legal procurement professionals.

Legal Spend Management Tools

What tools and tactics are being used in today’s marketplace to help legal procurement professionals better manage legal spend? Let’s first take a look at the most frequently used tools, then the tools that were found to be the most effective and then look at how technology is impacting the evolution of said tools.

According to the Buying Legal Market Intelligence Report, the most frequently used legal spend management tools are:

- Negotiating discounts

- Issuing and enforcing outside counsel billing guidelines (OCG)

- Negotiating alternative fee arrangements (AFAs)

- Issuing request for proposals (RFPs)

- Establishing a panel of preferred providers/firms

These five tools are the most basic methods used when legal procurement is trying to manage outside counsel spend and they have all been in place for many years. The more sophisticated legal departments have found the following tools to be the most effective when it comes to managing legal spend:

- Requiring eBilling

- Issuing and enforcing outside counsel billing guidelines (OCG)

- Conducting data analytics (spend and cost analyses)

- Negotiating AFAs

- Pre-matter scoping of work

The creation and enforcement of OCG in particular is an area that law firms need to put more of a strategic focus on. You will also see issuing and enforcing OCG on both the most frequently used and most effective lists. These guidelines typically include requiring eBilling, so we will group the top two items together.

The importance of OCG can best be summed up by this statistic from the 2021 Legal Department Operations (LDO) Survey which noted:

“According to the LDO survey, nearly 60% of clients have terminated a law firm because the firm ignored instructions or billing guidelines. Although some clients may choose to direct directly voice their displeasure with firms disregarding their directives, most clients don’t communicate to law firms that they’re on the verge of being fired. Instead, there’s usually a slow transition where clients shift work to other firms, and engagements dwindles.”

At the Legal Pricing and Practice Management (LPPM) 2021 Virtual Summit, this subject was discussed in more detail where the following reasons were noted as being tied to termination:

Poor compliance with OCGs and other expectations

- Exceeding budgets; not following communication and reporting guidelines

- Applying incorrect rates and over- or under-billing

- Providing little or no transparency to fee arrangements

- Using billing codes that don’t align with internal business unit codes

- Providing incorrect billing that burdens internal operations

- Failing to meet staffing requirements on factors such as diversity or the leverage and use of lawyers

- Falling behind other panel firms in commitments (e.g., value offerings, secondments, tech solutions, etc.)

Poor communication and feedback

- Providing little or no communication on matter status

- Surprising clients with a large amount of legal fees

- Taking an approach that does not align with business goals

- Failing to follow defined client processes

(Source: Improve Outside Counsel Guidelines Management to Reduce Client Attrition)

One trend we are seeing is that risk collars are being used more often as a way for the legal department and law firm to agree to a fixed fee.

New Developments and Disruptive Technology

The Market Intelligence Report notes that “legal technology is playing an increasingly important role in helping increase efficiency, improve transparency and data analytics, streamlining time-consuming processes, ensuring quality and consistency, and reducing time spent on low-value work.” There are all kinds of emerging legal technology companies who are developing products that allow legal departments to better incorporate data analytics into the decision-making process. Companies are creating software platforms that incorporate artificial intelligence or other machine learning to predict the outcome of ongoing litigation, enable clients to assess the performance of their counsel by reviewing their history of outcomes, and assess arbitrators, jury members and judges for objectivity. Legal service providers should be aware of the new technology and how it’s being used by buyers of legal services.

What follows are three recent developments in the legal industry that are examples of the types of technology collaborations we are seeing in the spend management area.

1. Deloitte and PERSUIT team up on corporate legal spend management

a. “Drawing on Deloitte’s deep capabilities in legal spend management, paired with PERSUIT’s capabilities to transform the process of engaging law firms and reducing legal costs, in-house legal departments can better navigate the process of outside counsel selection and management.”—Steven Walker, managing director of legal business services at Deloitte Tax LLP

2. Onit Acquires Bodhala, Linking Actionable Legal Spend Intelligence to Its Enterprise Legal Management Solutions

b. Bodhala “provides corporate legal departments with in-depth analytics and spend optimization solutions based on real-time market intelligence. Powered by machine learning and AI, Bodhala transforms messy data into actionable, high-impact insights…”

3. Orrick, Hearst Help Priori Develop Outside Counsel Tool

c. “Scout creates a custom database and robust dashboards for legal departments about their valued outside counsel relationships. In-house teams can search information on lawyer and law firm experience, diversity, and relationship and pricing history, along with reviews, to enhance department-wide knowledge about valued firms, identify the right staffing for new projects and track outside attorney performance over time.”—Basha Rubin, Priori CEO and co-founder

These developments also support the findings of the Buying Legal report, which predicts further growth in the future for legal tech tools such as:

- Workflow automation

- Reporting and analytics tools

- RFP software

Gartner research also suggests that by 2023, “33% of corporate legal departments will have a dedicated legal technology expert to support the increasing automation of core in-house workflows.”

Is summary, the Buying Legal Council 2021 Market Intelligence Report is a valuable resource for law firms to better understand the purchasing behavior of legal procurement professionals. The more they understand the metrics being used and the technology advances being incorporated, the more likely they will be able to keep clients happy and win new business.